When to sell your parents' home: The tax consequences - Ross Law

$ 17.99 · 4.9 (144) · In stock

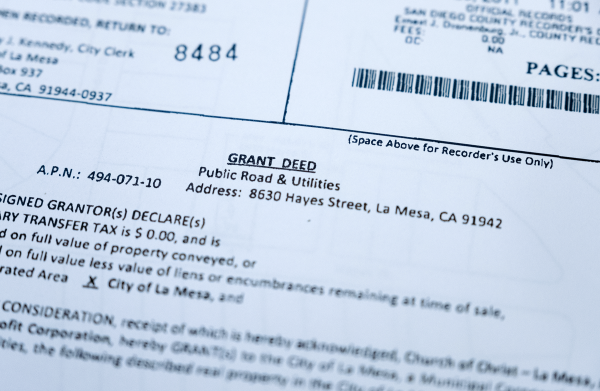

Let’s say you’ve known for years that you are inheriting your father’s home when he dies. Hopefully, you also know that he has a will that indicates clearly that the house will go to you.

[Ross MD PhD, Theodora, Mukherjee, Siddhartha] on . *FREE* shipping on qualifying offers. A Cancer in the Family: Take Control of Your

A Cancer in the Family: Take Control of Your Genetic Inheritance

Selling Parents House Before Death

Selling Parents House Before Death

58551 Ross Rd, Warren, OR 97053, MLS# 23179194

On Death and Dying: Elisabeth Kubler-Ross: 9780684839387: : Books

Tax Consequences of Selling Your Home

Selling a House Before 2 Years: Is There a Tax Penalty?

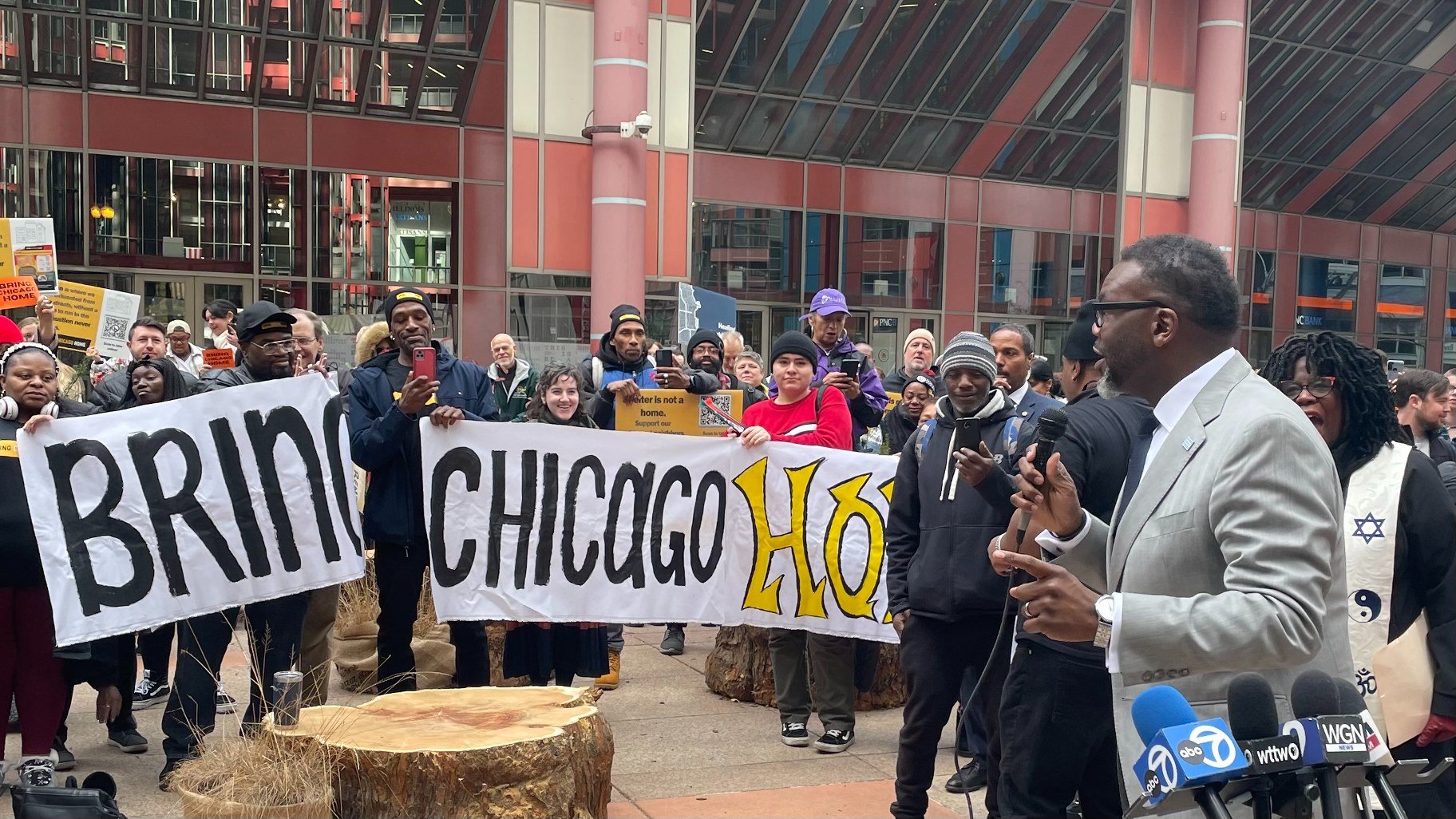

Chicago Voters to Decide Whether to Hike Taxes on Sales of Million-Dollar Homes to Fight Homelessness, Chicago News

Opinion The Rise of Single-Parent Families Is Not a Good Thing - The New York Times

What You Need to Know for the 2023 Tax Season - The New York Times

Alabama lawmakers file bill to stiffen consequences for false reporting

Not-so-simple stewardship - The Christian Chronicle

What is the Florida Homestead Exemption?