What Happens When You Don't File a 1099? - TurboTax Tax Tips & Videos

$ 10.00 · 4.8 (496) · In stock

Learn about what happens if you forget to file a 1099. See how to fix mistakes, amend your return, and avoid potential issues with the IRS.

Are Gambling Winnings Taxable? Top Tax Tips - TurboTax Tax Tips & Videos

What is Form 1099-NEC? - TurboTax Tax Tips & Videos

1099-NEC Schedule C won't fill in : r/TurboTax

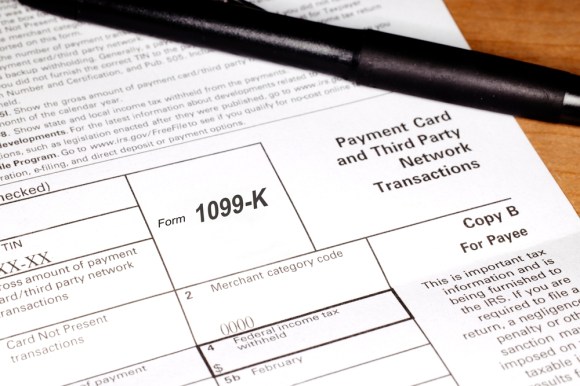

1099-K Form Reporting Threshold Delay Announced For Tax Year 2023 - Intuit TurboTax Blog

How TurboTax Safeguards Our Customers' Data - TurboTax Tax Tips & Videos

What Is the IRS Form 1099-MISC? - TurboTax Tax Tips & Videos

Video: How Does a Furlough or Lay-off Impact Your Taxes - TurboTax Tax Tips & Videos

1099-MISC vs. 1099-NEC vs. 1099-K: Understanding the Differences- Intuit TurboTax Blog

Penalties for Missing the 1099-NEC or 1099-MISC Filing Deadline - TurboTax Tax Tips & Videos

Calculating Taxes on IRS Form 1099 Misc - TurboTax Tax Tip Video

Video: Taxes & Divorce: Here's What to Know - TurboTax Tax Tips & Videos

Explain discrepancy? 1099-R: box numbers in Turbo tax don't match IRS form. Example, TurboTax says State ID number is box 16; Form 1099R has it in box 13?